A

consolidated profession is the opposite: a small group of companies or

organizations dominating the profession. The remainder of the business market

remains fragmented.

The

first problem of a fragmented profession is inefficiencies. Virtually all

products and services are sold to customers and clients are “retail” … one by

one. This is the most expensive way. This includes not only legal

services of lawyers themselves but virtually all associated products and

services. Retail sales is the natural extension of the fragmented market.

The

second problem is that fragmented professions make ideal targets for firms

looking to enter and potentially dominate and disrupt the market. Markets

can be readily assimilated. This is similar to the Borg in Star Trek seeking to

assimilate every alien being … their mantra is “resistance is futile”. The

nature of fragmented professions means that they often provide

fewer barriers to the disruptors. This makes fragmented businesses or

professions highly appealing for strategic disruptors.

Warren

Buffett said: “In business, I look for economic castles protected by

unbreachable ‘moats.’”[3] An

investor will be looking for a profession with a highly defensible market

position. “The issue is that the many competing businesses and firms have spent

their time and resources on fighting each other rather than maintaining a moat

to protect themselves from disruption.”[4] This

allows the new consolidating competitors to build bridges across the moat. The

fighting continues while the castle is being breached. The new competitor can

sell wholesale to a larger market and at a greater profit.

As Michael

Porter states in Competitive Strategy: Techniques for Analyzing Industries

and Competitors [5]: “Overcoming fragmentation can be a very significant strategic

opportunity. The payoff to consolidating a fragmented industry can be high

because the costs of entry into it are by definition low, and there tend to be

small and relatively weak competitors who offer little threat of retaliation.”[6]

The cost to

the fragmented market providers can be very high because the fragmented system

is suddenly replaced. Adaption to the new market require tremendous efforts.

Understanding

Market Fragmentation

Fragmented

markets consist of small, medium, and even relatively large organizations that

compete with one another. No single organization or group of organizations

dominates the entire global market.

In

a fragmented market establishing and maintaining a brand is key. A brand reputation must

reverberate throughout the marketplace. It must distinguish the firm or company

from its competitors. This can be difficult in one state or country, and is

multiplied in a global market.

On

the other hand, in law, implementing a fragmented industry strategy means firms

do not need to concern themselves about fighting for market share against major

firms who may be in another distinct segment. They can develop their practices

in a number of segments at a relatively low cost at a relatively high rate of

return. This ensures that they are taking advantage of the fragmented

profession as it relates to new opportunities.

Examples of a

fragmented market include clothing retailers, businesses selling furniture,

agriculture, and landscaping, book publishing, bulk building supplies, and

others. [7] In a fragmented market, product and service

segmentation can be intense, responding differently to marketing. These

multiple segments are also indicative of a fragmented market.

This is not

to say that in a fragmented market, product and service segmentation can be

intense, responding differently to marketing. These multiple segments are also

indicative of a fragmented market.

A market

becomes fragmented for many reasons. Some are: 1.The needs of clients; 2.

Generally a low level of innovation in products and services; 3. No economies

of scale; 4. Strong competition in the market; and 5. Customization of the

product is high within the segments.[8]

Advantages of a Fragmented market

Fragmentation

works well in specific businesses. A fragmented market can help businesses

reach the right consumers and clients. Based on demographics, behaviors, and

interests of the consumer, a fragmented market makes it easier for businesses

to target their products to

specific consumers and clients.

Since

there is no dominant player in a fragmented market, it implies that clients

have not given their loyalty to any business and that few standards exist in

that market. This also implies that new entrants in the market have latitude

for investigation and innovation of new products and services.[9]

Fragmented

markets may lead to a smaller client base, which makes it easier for businesses

to pinpoint the interest of their clients more effectively. Marketing expenses

of businesses may be reduced in a fragmented market. In many cases, the

marketing is focused on local or regional clients. The advertising expenses are

less than nationwide or global coverage.[10]

A

fragmented market favors firms with a smaller footprint. For example, with

entry of the Big 4 into the legal profession, the largest law firms will incur

incremental expenses to compete while the Big 4’s are scalable being spread

across more markets. Thus, it is cost-effective for firms trying to enter a

fragmented market not to start new practices. A fragmented market also gives

firms an opportunity to target clients

that other firms in the legal profession may have missed.

Disadvantages of a Fragmented market

One firm’s

advantage is another’s disadvantage. Like any other market, a fragmented market

has its own set of challenges. As markets fragment, businesses need to be aware

of the multiple platforms that can be used to reach their target clients and

then use these to market themselves. As such, it becomes important for firms to

track every change in the marketplace since their competitor are doing the

same.

In

a fragmented market, firms also need to ensure that their marketing strategies

are consistent and adapted to the qualities of a different marketing methods.

In a fragmented market, the need for continuous repetition of branding messages

is a common issue.

Segmentation

Segmenting

follows both fragmentation and consolidation. At its most fundamental level, it

is the separation of a group of clients with different needs into subgroups

with similar needs and preferences. By doing this, a firm can better tailor and

target its services to meet each segment’s needs.[11]

Characteristics

of segmentation are: [12]

· Firms rarely create a

segment — more often they uncover one.

· Segmentation and demographics

are very different things. Demographics such as age, sex, religion, etc. are

not segments. Segments are the interests of individuals or businesses cutting

across demographics.

· Segmentation decisions are

made based on information.

Regardless

of the approach, a useful segmentation strategy would include these six

characteristics: 1) Identify each segment and measure their

characteristics, like demographics or usage behavior; 2) Must be large enough

to be potentially profitable; 3) Should be able to reach its segments via

communication and distribution channels; 4) Should be stable enough for a long

enough period of time to be marketed strategically; 5) A segment should have

similar needs that are clearly different from the needs of others in other

segments; and 6) Actionable to be able to provide products or services to each

of these segments.[13].

Law

and Accounting – Fragmentation and Consolidation

Law

Institutional

fragmentation has served the legal profession well for 50 years. In modern

times, the possibility to consolidate appeared unlikely because each state

or country has its own bar regulations and each law school its own curriculum,

their own courts, procedures, etc. A significant professional ethical

moat was created.

Clients

did not require a consolidated profession in the non-global marketplace. In

each segment of law there were firms that could meet the legal services needs

of clients from the smallest to the largest. However, even the largest had

extremely limited coverage. Their offices are predominately in 15 popular

locations, such as New York, London, Paris, Brussels, Chicago, Hong Kong,

Tokyo, and Frankfurt. Networks and ad hoc personal connections filled the gap

in market coverage.

The

legal media has also effectively protected the legal services business with

terminology describing the largest firms as members as the AmLaw 100, White

Glove or Magic Circle firms. The media’s focus remained primarily on the

largest law firms because they were the best known. This provided significant

low-cost brand awareness and marketing.

The

legal profession was also lucky that Enron occurred and Sarbanes Oxley held off

the Big 4’s strategy of consolidation. Regulations in the United States may,

however, be changing in several states to open legal practice to partnerships

with non-lawyers.[14]

What

has changed? Today, size has become even more important. When one compares the

revenues of the 100 largest law firms with the Big 4, they equal the combined

revenues of just two: Deloitte and PwC. The 100 largest firms are in, on

average, 15 countries compared to the 160 of the Big 4. This creates the

opportunity to scale services in each market based upon clients’ needs.

Alternative Legal

Services Providers (ALSPs) – Erosion of Legal Services

ALSPs

represent the point of connection between law and law-related services. The

market for these services is fragmented. None of these organizations is

restricted by legal ethics in that they do not practice law. Without similar

restrictions, they can be more innovative in their approach to legal business. [15]

At

present, there is no dominant organization. This is changing. Elevate Services

is consolidating a number of these services with acquisitions. The Big 4 are

developing these services to be offered worldwide to firms and corporations.

They are also acquiring larger alternative providers.[16]

While

a number of large law firms [17] are

investing in their own versions of ALSPs, general fragmentation of the market

makes this difficult since marketing them is not within their core

competencies. There are many startups in this sector. Segmentation is also made

more difficult when the largest business organizations like the Big 4 and the

four largest companies (Lexis Nexis, Bloomberg, Thomson Reuters, and Wolters

Kluwer) occupy adjacent spaces.

The

Internet: Redefining Fragmentation and Segmentation

The

Internet introduces two new consolidation factors. [18] Unlimited

information is now available on products and services. Existing brands

themselves can be consolidated by creation of new delivery modes. This is a

different form of consolidation.

Information in a

consolidating market

The

Big 4 and the largest law firms combine useful information with modes of

delivery. Today, it is possible to separate delivery of information from legal

practices. In other words, market share can be developed without the burden of

developing a legal practice through providing information that places potential

business clients in direct contact with vetted firms and lawyers. The potential

client can then make their own evaluation of the lawyer’s expertise and

comparative cost in real time.

An

example in retail is Amazon.[19] They have adopted a model of consolidating multiple products and

services under one roof by making comparative information available on each

product. Its market share is unlimited because it concentrates on information

distribution first, and then distribution of others’ products and services. The

result is that the “retail” industry has been rocked by this change in the

information distribution structure. Stores cannot offer the same broad choices

or a cost-effective delivery system for a single product line. Why go to a

store when the same toy is available on Amazon for a lesser price and it is

delivered the next day to your home for free?

Another

similar example is Uber. It has taken a completely fragmented business,

personal transportation, and consolidated it. It was followed by Lyft.

Social Media Disruption -

Brands

The

Internet also exploits brands, which each of the Big 4 already has. A

comparison of the number of monthly users is indicative of their market power.

For example, Big 4 firms each receive 10 times the number of unique users per

month than the sites of largest law firms. [20] The Big 4 all ranked among the top 100 brands in the world. [21]

The Tale of Two Futures – Assimilation or Legal Independence?

The

merging of accounting/consulting and law could result in the entire legal

profession dominated by the Big 4. This assumes there is no alternative

consolidation model. This does not have to be the case. There is one unknown in

the market that could consolidate a greater market share than the combined Big

4 and can offer more services.

Big 4 –

Assimilation of legal services and the profession

The

best strategy to disrupt a fragmented market such as the legal profession is

“to develop a multi-sided platform model which does a better job of meeting

unmet demand or allocating resources more efficiently, either for the benefit

of incumbents, consumers, or ideally both.” [22] Opportunities in fragmented industries are found for

entrepreneurs willing to provide the right sort of platform. These are

segmentation opportunities.

The

moat surrounding the legal profession’s proverbial castle is not deep or wide

enough to stop the Big 4. Their breadth and depth of their new moat are

increasing daily. The results are as follows:

1. Global – The legal and accounting markets are global. The Big

4 have operations in 160 countries. Large law firms are predominately

based in the U.S. or England. Conversely, the footprint of the largest law

firms are, on average, fewer than 20 countries. Their comparative global

footprint to law firms is reflected in the percentage of lawyers outside of the

United States. [23]

2. Scope of services – Services are broad, including broad

spectrum of advisory services. Legal services are only one additional service

that the Big 4 offer.

3. Technology – The Big 4 are developing internally scalable

technology that can be offered to their clients and potential clients. The

technology is scalable, so it can be offered to the full range of clients.

4. Local presence – The Big 4 are already part of local business

and not perceived as foreign. They represent more business clients

outside of the dominant countries. As these clients expand, they use the Big 4.

This is a version of the network effect.[24]

5. The legal media has officially recognized them as part of the

legal profession.[25] There

are now countless articles on the Big 4 gradually extending to legal practices.

6. The Big 4’s financial resources are essentially

unlimited.

7. The Big 4 are rated among the 100 most recognized brands in

the world. No law firm is even close to this level of brand recognition. They

are now being ranked specifically within the legal market.

8. The Big 4’s structural model is a network rather than

integrated firms, which creates flexibility in their operations and continuous

opportunities to expand at lower costs.

Alternative Future –

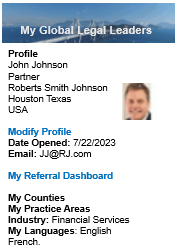

Consolidation with GlobalLegalLeaders.com

Consolidation

of Law and Accounting through Networks and Associations to carve out $300

billion of services

In

a fragmented market, the only defensive opportunity lies with the potential

consolidation of a significant part of the B2B legal profession. This

means the consolidation of legal and accounting networks with other companies

who have something in common: offering their clients comprehensive quality

services and common competition: the Big 4.

The

combination of law and accounting networks with other providers such as AI,

Blockchain, and other technology can create something larger than the Big 4. An

Internet platform creates a more effective organization in that it can

simultaneously incorporate (assimilate) other associated by business at no significant costs to provide clients. Each firm or company

remains completely independent.

Utilizing

the same models underlying Amazon, LinkedIn, and Uber, an alternative can

easily be implemented. All that is necessary is:

1. Carving out legal and accounting firms that are members of

networks. The members of 75 networks annually provide $180 billion in services

to clients. This is 15% of a $1.1 trillion market, which effectively defrags

the markets. They have been jointly organized over the last four years.

2. Utilization of the investment of several billion dollars already

spent to develop professional and personal relationships among members of law

and accounting networks over 30+ years. (Similar to Uber where drivers use

their own cars.)

3. Exclusively providing access to the exact expertise and

experience of 600,000 vetted professionals at 10,000 firms virtually

everywhere on earth in minutes.

4. Offering the only real-time use of the system to

all professionals in the world for free. This makes all business lawyers and

accountants global.

5. Developing a continuing customer relationship as a result of

the personal dashboard management system for each user and replying firm.

(Similar to LinkedIn.)

6. Incorporating virtually any service or product related

to law and accounting for users, tagging each to the matter for secondary

product and sales. (The “one-stop shop” model of Amazon.)

7. Creating a global minable meta-database of transactions and

litigation matters deployable for product and service creation. The same

database can also be deployed for the sale of transaction and litigation

analytic products and services.

8. Assembling a built-in customer database of 10,000 legal and

accounting firms for products and services. They can be marketed through the 75

networks to their members. This creates an unlimited number of potential

clients for these new incremental services.

9. Creating a proactive vendor “market” by placing

products and services such as ALSP services in front of users based upon actual

matters – a form of AI dynamic personalization. (Similar to Amazon – “People

who purchased X also purchased Y.”)

10. Operating with minimal administrative or financial

costs. Maintenance and expansion work can be done by users, firms, and

networks. (Similar to LinkedIn.)

11. Developing scalable AI and blockchain applications that can

be incorporated and sold to network member firms, user firms, and

organizations.

12. Growing a network’s user base at no cost as

other professionals within the firms are brought into the matter or

litigation. The network’s effects are similar to Facebook and LinkedIn.

No app needs to be downloaded to participate.

13. Transforming the retail market to wholesale for

vendors of law- and accounting-related products and services by sales through

the networks to their members, reducing the overall cost of sales.

14. Generating potential horizontal and vertical revenue streams

of an estimated $30 - $50 million within the first 18 months. This requires

first establishing identifiable brand credibility with the 10,000 firms on the

site.

Conclusion

The

fragmented legal profession is now confronting organizations that have already

consolidated globally. As networks, the Big 4 has flexibility that law firms do

not have to easily add services to their client menu. They have a staff in each

country that is able to market new products and services to existing and

prospective clients. Compared even to the largest law firms, their resources

are basically unlimited. Without the intervention of another organization,

there is a real possibility that the legal market in 2025 will resemble the

accounting market of today. The Big 4 will be the dominant force. Law firms

that will remain will be defined by a fragmented market.

Certain

segments may be largely exempt from domination, such as criminal lawyers. The

firms most affected will be firms of 30 to 1,000 B2B

lawyers. Outside of the U.S. all commercial and IP firms will feel the

changes. Others will be exempted as long as the Big 4 do not see their segments

as profitable.

There

is a better alternative than the Big 4. Under GlobalLegalLeaders.com networks, firms and

others services providers are able to work for common objectives. They can make

available to clients a broader source of services at the same quality and a

lower cost … a new wholesale marketplace is created.

_____________________________________________________________

[1] Stephen J. McGarry: BA, MA, JD, LLM (Tax) Admitted: TX

LA MN Founded: Lex Mundi and WSG - the world's two

largest law firm networks (Combined 44,000 attorneys in 1,200 offices

with annual revenues of $20+ billion). Created: HG.org, one of

the first 10 legal websites in 1995 (Today receiving 1.3 million unique users

per month). Met in person with over 400 law firms in

more than 100 countries and every US state and Canadian province. Published: Numerous

publications including ALM’s Multidisciplinary Practices and Partnerships, the only treatise on the Big 4 in law. Languages: French,

German, Spanish Featured in: Wall Street Journal, American

Lawyer, IFLR, National Law Journal, Legal Business, Financial Times and other publications.

[2] The Borg is a fictional alien

race in Star Trek - The Next Generation. The

Borg are cybernetic organisms, linked in a hive mind called "the

Collective." The Borg co-opt technology and knowledge of other alien species for the Collective through the process of "assimilation": forcibly transforming individual beings into

"drones" by injecting nano-probes into their bodies and surgically augmenting them with

cybernetic components. The Borg's ultimate goal is "achieving

perfection." https://en.wikipedia.org/wiki/Borg; The Borg,

YouTube: https://www.youtube.com/watch?v=WZEJ4OJTgg8.

[3] Matt Linderman, Warren Buffett on Castles and

Moats, Basecamp (March 27, 2007), https://signalvnoise.com/posts/333-warren-buffett-on-castles-and-moats.

[4] Id. at 3.

[5]Michael Porter, Competitive Strategy: Techniques for

Analyzing Industries and Competitors, available at

https://www.amazon.com/Competitive-Strategy-Techniques-Industries-Competitors/dp/0684841487.

[6] Id.

[7] Hitesh Bhasin, What is a Fragmented Market?, Marketing

91 (August 10, 2018), https://www.marketing91.com/fragmented-market/.

[8] Id. at 7.

[9] Id.

[10] Id.

[11] Market Targeting – Target Segments Efficiently and

Effectively, Marketing Insider Europe,

https://marketing-insider.eu/marketing-explained/part-i-defining-marketing-and-the-marketing-process/market-targeting/.

[12] Gretchen Garett, What You Need to Know about

Segmentation, Marketing (July 9, 2014),

https://hbr.org/2014/07/What-you-need-to-about-segmentation.

[13] Id. at 12.

[14] Sam Skolnik & Amanda Iacone, Big Four May Gain

Legal Market Foothold With State Rule Change, Bloomberg

Law (April 11, 2019),

https://biglawbusiness.com/big-four-may-gain-legal-market-foothold-with-state-rule-change.

[15] James Goodnow, Meet the Alternative Legal Service

Provider Bent on Taking over the World, United Lex (April 19,

2019), https://abovethelaw.com/2019/04/unitedlex-luthor/

[16] Michael Kapoor, EY Continues Legal Push, Acquires

Thomson Reuters’ Operation, Big Law Business (April 3, 2019),

https://biglawbusiness.com/ey-continues-legal-push-acquires-thomson-reuters-operation.

[17] Robert Ambrogi, Why EY’s Purchase of Pangea3

Should Be a Wake-Up Call for Law Firms, Above the Law (April 9,

2019),

https://abovethelaw.com/2019/04/why-eys-purchase-of-pangea3-should-be-a-wake-up-call-for-law-firms/.

[18] Dominic Carman, Will Technology Kill All the

Lawyers? Global Legal Chronicle (April 15, 2019),

http://www.globallegalchronicle.com/will-techology-kill-all-the-lawyers/.

[19] The retail apocalypse has claimed 6,000 U.S. stores in

2019 so far, more than the number that shut down in all of 2018 (April 17,

2018),

https://www.thisisinsider.com/retail-apocalypse-start-of-2019-more-store-closures-all-of-2018-2019-4.

[20] See Similarweb.com: PWC vs. Baker McKenzie:

https://www.similarweb.com/website/pwc.com?competitors=bakermckenzie.com#.

[21] Raymond Doherty, PwC has most powerful brand

of Big Four, Economia, 2 Feb 2017,

https://economia.icaew.com/news/february-2017/pwc-has-most-powerful-brand-of-big-four.

[22] How do you identify a fragmented industry?,

https://marketplacer.com/blog/how-do-you-identify-a-fragmented-industry/.

[23] Nicholas Bruch, ALM Legal Compass Snapshot: The

NLJ 500, LAW.COM (June 28, 2018),

https://www.law.com/2018/06/28/alm-legal-compass-snapshot-the-nlj-500?et=editorial&bu=ALM%20Intelligence&cn=20180628&src=EMC-Email&pt=Analyst%20Brief.

[24] Wikipedia, Network effect,

https://en.wikipedia.org/wiki/Network_effect.

[25] There have been more than 100 articles and blog postings

during 2018 on the legal practices of the Big 4.

[26] Id. 4

Software

Software Law

Law Legal

Legal